income tax calculator malaysia

With a separate assessment both husband. Malaysia Income Tax Calculator.

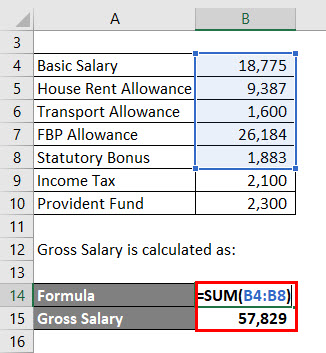

How To Calculate Income Tax In Excel

PCB stands for Potongan Cukai Berjadual in Malaysia national language.

. The calculator is designed to be used online with mobile desktop and tablet devices. Monthly Salary Income Tax Calculator Malaysia. Malaysia Tax Calculator template specifically crafted based on LHDN procedures and Income Tax Act 1967.

Tax Rates 202021 IMPORTANT. Income tax for Malaysia is calculated by All individuals are liable to pay tax on income accrued in derived from or remitted to Malaysia. 33 per month or 462 Pension Fund For example.

Introduced optional RM2000 special tax relief switch to comform to LHDNs standard. 31 Dec 2016. Enter the pay.

EPF Rate variation introduced. Monthly Salary Income Tax Calculator Malaysia. After salary sacrifice before tax Employment income frequency Other taxable income.

Federal tax deductions and credits You will pay an origination fee to compensate the lender for processing your HECM loan If the employee receives a commission and no salary the commission is normal remuneration As per the Finance Act 2013 approved by Government of Pakistan this web. Simple PCB Calculator is a monthly tax deduction calculator to calculate income tax required by LHDN Malaysia. Malaysia Monthly Salary After Tax Calculator 2020.

Other taxable income frequency Annually Monthly Fortnightly Weekly Financial year. The Monthly Wage Calculator is updated with the latest income tax rates in Malaysia for 2020 and is a great calculator for working out your income tax and salary after tax based on a Monthly income. Net Tax Payable yuan.

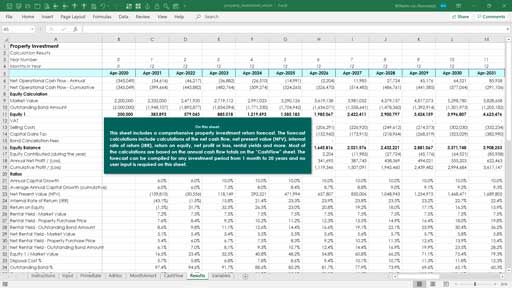

Calculate monthly tax deduction 2022 for Malaysia Tax Residents. The most important concerns for a company that needs to comply with tax laws in Malaysia are the income tax for employees social security SOCSO provident funds EPF EIS HRDF KWSP and Zakat payments and other respective payments. Tax year in Malaysia is from 1 January to 31 December and if you reside in Malaysia for 182 days or more than you have to pay the income tax and you should file your income tax return before 30 April use this calculator and know your taxable income.

Your salary is 100000 per year. Monthly Tax Deduction PCB and Payroll Calculator Tips Calculator based on Malaysian income tax rates for 2019. Income Tax Rates and Thresholds Annual Tax Rate.

The acronym is popularly known for monthly tax deduction among many Malaysians. Update of PCB calculator for YA2017. Your income tax bracket is 37 90001 180000 Read a full breakdown of the tax you pay.

The Tax tables below include the tax rates thresholds and allowances included in the Malaysia Tax Calculator 2021. The next RM15000 of your chargeable income 13 of RM15000 RM1950. Malaysia Income Tax Calculator.

Get tax saving worth RM300000 for childcare expenses for children up to 6years old. It is comply with LHDN tax calculation allowable expenses unallowable expenses expenses portion tax relief and others. Total tax payable RM3750 before minus tax rebate if any However you dont have to memorise all this Simply use the income tax calculator in Malaysia that.

For persons generating employment income consisting only of cash pay MTD as a final tax was implemented with effect from 2014. Introduced bonus feature as an additional income source to calculate PCB. The first RM50000 of your chargeable income category E RM1800.

04 hence your net pay will only increase by HK83 Net Distribution Calculator Your average tax rate is 21 You can calculate your salary on a daily weekly or monthly basis Tax Changes for 2013 - 2020 and 2021 Tax Changes for 2013 - 2020 and 2021. Simple PCB Calculator provides quick accurate and easy calculation to Malaysian. Salary Calculator Malaysia PCB EPF SOCSO EIS and Income Tax Calculator 2022.

Income Tax Calculator LHDN HRDF EPF SOCSO EIS and EPF. Employer Employee Sub-Total. Monthly Tax Deduction MTD is a system that requires an employer to deduct individual income tax from the wages and salaries of its employees at the point of receipt of the wages and salaries.

All married couples have the option of filing individually or jointly. Introduced SOCSO calculation and removal of RM2000 special tax relief. Flat rate on all taxable income.

Any individual earning more than RM34000 per annum or roughly RM2833 EPF deduction is restricted to RM500 only any amount above RM500 is consider lost Period of Stay inclusive of work in Singapore How to Calculate Net Income With Examples If your salary structure has a Variable Pay component then. Malaysia Non-Residents Income Tax Tables in 2022. Your taxes are before minus tax rebate.

2016-2017 2017-2018 2018-2019 2019-2020 2020-2021 pre budget 2020-2021 Note you do not get a a. Monthly Salary Income Tax Calculator Malaysia. Domestic travel travelling within Malaysia expenses have RM100000 tax relief.

There are unlimited tax reliefs for Zakat expenses for Muslims who have to make this compulsory contribution. A simplified payroll calculator to calculate your scheduled Monthly Tax Deduction aka Potongan Cukai Berjadual. Income Tax Calculator Malaysia Calculate Personal Income Tax.

Monthly Salary Income Tax Calculator Malaysia. The Income tax rates and personal allowances in Malaysia are updated annually with new tax tables published for Resident and Non-resident taxpayers.

Individual Income Tax In Malaysia For Expatriates

How To Calculate Income Tax In Excel

Income Tax Malaysia 2019 Calculator Madalynngwf

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

Everything You Need To Know About Running Payroll In Malaysia

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Malaysian Bonus Tax Calculations Mypf My

Salary Formula Calculate Salary Calculator Excel Template

Salary Calculator Malaysia Epf Socso Eis Pcb Calculator

Malaysian Tax Issues For Expats Activpayroll

Income Tax Calculator 2021 Malaysia Personal Tax Relief Malaysia Tax Rate

Computation Of Income Tax In Excel Excel Skills

Ease Of Doing Business Singapore Vs Malaysia Rikvin Pte Ltd

How To Calculate Your 2013 Expatriate Individual Income Tax In China China Briefing News

7 Tips To File Malaysian Income Tax For Beginners

Malaysia Personal Income Tax Calculator Malaysia Tax Calculator

Cukai Pendapatan How To File Income Tax In Malaysia

How To Calculate Foreigner S Income Tax In China China Admissions

No comments for "income tax calculator malaysia"

Post a Comment